We help businesses put the power of accurate, real-time data at the heart of every business decision.

No more guesswork. Shepper's innovative platform empowers businesses to make data-driven decisions with confidence. Get affordable, real-time insights on any aspect of your business. From in-store product tracking to service evaluation and anything in between.

Case Studies

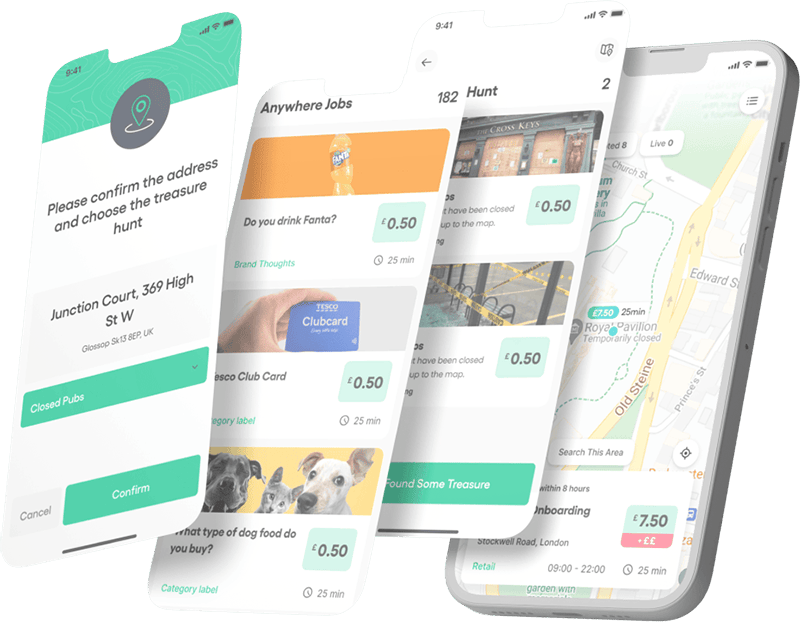

With over 200,000 ‘Shepherds’ located across every postcode, we can capture data in real time that was previously impossible to obtain.

Providing cost-effective, high-quality insights to help you make better decisions.

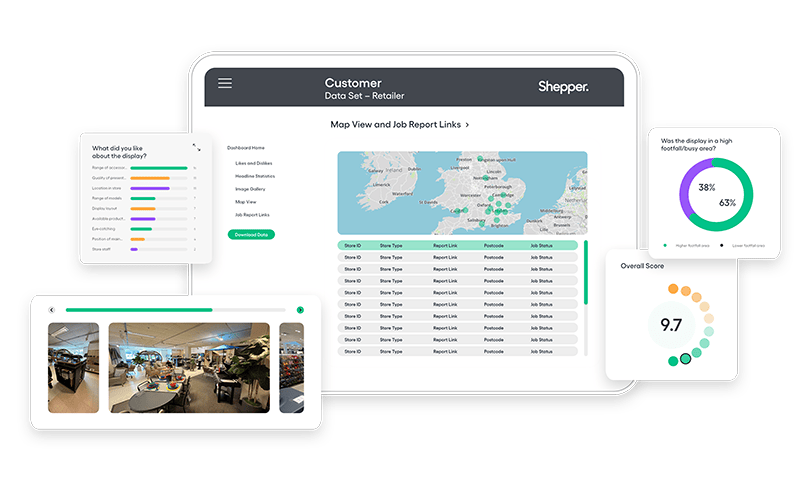

Our proprietary AI technology reveals patterns and trends that may previously been overlooked. Combined with proactive anomaly detection we guarantee accuracy and reliable insights.

Don’t settle for guesswork, put the power of current data and logic at the heart of every business decision.

Made to measure dashboards tailored specifically to your requirements display your data in real time. Forget configuring data streams or complicated API’s - everything is set up ready to help your business make better decisions.

Case Studies

See firsthand how our innovative on-demand data solutions are transforming businesses.

Browse all Case StudiesExplore Our Work

I need